Facebook’s $119 Billion 1-Day Rout Makes US History

AGENDA 21 RADIO

NEWSMAX

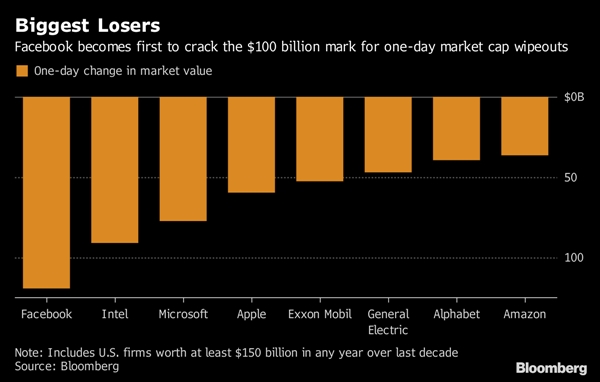

It’s official. Facebook Inc. just had the biggest stock-market wipeout in American history.

Shares (FB) tumbled 19 percent on Thursday to close at $176.26 after sales and user growth disappointed investors.

The drop translates to a $119.4 billion decline in market capitalization, the largest-ever loss of value in one day for a U.S. traded company.

Facebook plunged after months of scandal and criticism finally hit the company where it hurts: growth.

The social-media goliath’s financial performance had previously seemed immune to fierce critiques of its content policies, its failure to safeguard private data, and its changing rules for advertisers. But on Wednesday Facebook reported sales and user growth numbers for the second quarter that fell short of analysts’ projections, leaving investors reeling.

The company told Wall Street the numbers won’t get any better this year. Chief Financial Officer David Wehner said revenue growth rates would decline in the third and fourth quarters. Analysts who follow Facebook were blindsided, asking frequently on a conference call with executives for more information on exactly how the company’s financial future had changed so dramatically.

Before the results, Facebook had 44 buy ratings, two sells and two holds. A few analysts tempered their outlook Thursday.

For Facebook, financial stumbles are rare. The last time the company missed revenue estimates was the first quarter of 2015. But the results followed a period in which data-privacy issues came under harsh scrutiny, with Chief Executive Officer Mark Zuckerberg testifying before U.S. Congress for hours on the company’s missteps.

The quarter was also marked by Europe’s implementation of strict new data laws, which Facebook said led to fewer daily visitors in that region. The company was bombarded by public criticism over its content policies, especially in countries such as Myanmar and Sri Lanka where misinformation has led to violence. And it continued to suffer fallout from investigations into Russian manipulation of the platform during the 2016 U.S. presidential election.

All of those problems are hitting amid a harsh truth for the company: Facebook, the social network with 2.23 billion active monthly users, can’t grow forever. “The core Facebook platform is declining,” said Brian Wieser, an analyst at Pivotal Research Group.

Revenue increased 42 percent to $13.2 billion in the quarter. Analysts projected $13.3 billion. The social network still holds one of the world’s most valuable sets of data on what people are interested in, and makes that audience easily available to advertisers. The company remains in a dominant position in mobile advertising alongside Alphabet Inc.’s Google.

“As we have written about extensively, the advertising industry – and digital advertising no less – has limits to growth, which we think is the primary factor constraining Facebook’s revenue opportunity,” Wieser said in a note after the earnings. “Deceleration such as management guided toward suggests that while the company is still growing at a fast clip, the days of 30%+ growth are numbered.”

After the General Data Protection Regulation went into effect in Europe, Facebook started asking people to check their privacy settings and make sure they wanted to share certain kinds of data. Facebook is rolling out a version of those protections to the rest of the world.If users choose to share less data with Facebook, that could hamper the company’s ad-targeting abilities, making it less attractive to marketers.

While privacy was an issue in Europe, politics played a role in North America, which is the company’s most lucrative advertising market. Facebook disrupted some business by putting in place new rules to get all political advertisers to verify their identities. The company may have halted more ad purchases than expected as it applied a broad definition of what’s considered “political.”

After the earnings report, executives worked to explain the potential of Facebook’s other properties, not just the main social network, to fuel growth. The company owns three other properties with more than 1 billion users: WhatsApp, Messenger and Instagram. Together, the entire Facebook suite of products has 2.5 billion unique monthly users, the company disclosed for the first time.

Facebook has said it will increase spending to make investments in video content, and on new bets like artificial intelligence and virtual reality. The company is also rapidly expanding its real estate around the world to accommodate a hiring spree, which includes thousands of new workers to help combat foreign election manipulation on the site. The company said headcount was 30,275 as of June 30 — an increase of 47 percent year over year.

Before the results were announced, Facebook’s shares had closed in New York at $217.50, a record high, and had gained 23 percent this year.

The revenue guidance from the company was “unprecedented,” said Gene Munster, an analyst at Loup Ventures, in a note to investors. But Facebook, which reported sales growth averaging 50 percent the past 10 quarters, may just be lowering the bar so it can win back confidence in future quarters.

“The company has a track record of resetting revenue growth and expense expectations only to turn around and exceed those expectations the following quarter,” Munster wrote.

Read Newsmax: Facebook Plunges After Slowing Growth Draws Analyst Downgrades | Newsmax.com

Important: Find Your Real Retirement Date in Minutes! More Info Here